International Organisation for Standardization (ISO) Launches Global ESG Implementation Principles at COP29

The introduction of the ISO ESG Implementation Principles (IWA 48:2024) at COP29 marks a significant milestone in the global effort to standardise and streamline ESG practices. For years, organisations have grappled with a fragmented ESG landscape, where varied definitions, overlapping frameworks, and inconsistent reporting metrics created confusion and scepticism. With IWA 48, ISO has taken a commendable step toward providing clarity and fostering trust in ESG claims.

However, while the framework promises much, its success will hinge on several factors. First, the framework’s ambitious goal of universality—being applicable to organisations of all sizes, sectors, and jurisdictions—poses inherent challenges. Small and medium-sized enterprises (SMEs), particularly in developing economies, may struggle with the capacity and resources required to adopt such a comprehensive framework. Support mechanisms, including financial incentives and technical assistance, will be crucial to ensuring inclusivity.

Second, the focus on measurable KPIs and maturity levels is a welcome addition, but it also brings the risk of over-standardisation. ESG, by nature, involves diverse and context-specific considerations. While standardisation is necessary for comparability, it must allow room for flexibility and innovation. A balance must be struck to ensure that organisations can tailor their ESG strategies to reflect their unique circumstances while adhering to a consistent set of principles.

Additionally, while the framework admirably incorporates social and governance considerations—areas often overshadowed by environmental concerns—these dimensions remain complex and difficult to quantify. For instance, issues like equity and cultural maturity require nuanced approaches that may not easily fit within a KPI-driven system. Ensuring that these dimensions receive adequate attention without reducing them to tick-box exercises will be critical.

Perhaps the most pressing challenge lies in adoption and enforcement. The framework is voluntary, and its true impact will depend on the extent to which it is embraced by organisations and recognised by stakeholders, including investors and regulators. The role of governments and international bodies in promoting alignment with IWA 48 through incentives or mandates will be pivotal in driving widespread adoption.

Despite these challenges, the release of IWA 48 is a positive step forward. It has the potential to become a unifying force in the ESG space, aligning efforts across industries and geographies. Its emphasis on continual improvement and integration of ESG into organisational culture reflects a forward-thinking approach that goes beyond compliance to embed sustainability as a core value.

As the global community looks to transition from lofty climate commitments to tangible action, frameworks like IWA 48 can provide the structure needed to translate ambition into measurable progress. However, success will require collaboration, innovation and commitment from all stakeholders.

The Guidelines in detail

IWA 48:2024 aims to simplify compliance with disclosure requirements and improve the measurement, reporting, and communication of sustainability initiatives.

The principles were developed with input from over 1,900 experts across 128 countries and are aligned with the UN Sustainable Development Goals.

Environmental, Social and Governance (ESG) is a strategic and operational framework that assists organisations to implement and report on their activities, products, and services in order to demonstrate sustainable development, social justice and good governance.

The ESG landscape is extremely complex with many overlapping and competing ESG standards and frameworks, some mandatory, some voluntary, and some commercial. Different methodologies and performance indicators, varied definitions and competing approaches result in confusion, and this has undermined the trust in ESG claims which, in turn, has tended to discourage investment and further engagement in ESG by organisations.

To date, the tendency, understandably, has been to focus mainly on climate-related risks, resource use and circularity, such as achieving net zero and other environmental reporting requirements as attested to by inter alia, the CSRD. This environmental focus has been to the detriment of social and governance issues, which need to be embraced and incorporated into the workings of an organisation.

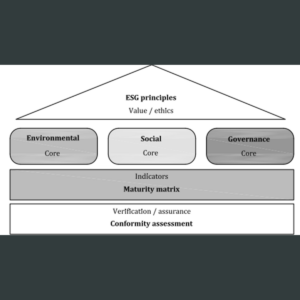

IWA 48:2024, as an ESG framework, provides overarching principles, a coherent structure and guidance for ESG including measurable key performance indicators (KPIs) to support the evaluation of maturity levels within the organisation, so that all relevant interested parties can be reassured that they are working within the same set of principles. The ESG framework is intended to be flexible so it can be applied to organisations of all sizes, sectors and jurisdictions.

The main components of the guidance document are presented in Figure 1 below.

The framework is broken down into ten clauses as follows:

1 Scope

2 Normative references

3 Terms and definitions

4 Principles and practices in ESG

5 Environmental

6 Social

7 Governance

8 Compliance and conformity

9 Reporting

10 Continual improvement

Clause 4.1 outlines the overarching principles of ESG as follows:

- Integrity

- Outcomes-focussed

- Equity

- Risks and opportunities

- Evidence-based

- Maturity

Clause 4.2 assists with the identification of ESG risks and opportunities, clause 4.5 outlines the key concepts of materiality and clause 4.6 defines a KPI measurement framework for ESG standardised reporting.

Table 1 contains information on ISO and IEC documents for guidance on generic ESG issues.

Clause 5 covers environmental considerations in a comprehensive manner including sections on the environmental framework, KPIs and a very useful table 2 on examples of actions that can be taken in relation to environmental considerations. Table 3 contains a comprehensive listing of ISO and IEC standards for environmental factors.

Clause 6 addresses social considerations of ESG and contains the following tables:

- Table 4 — Examples of actions that can be undertaken in relation to social dimensions

- Table 5 — Examples of issues in relation to identification of social risks and opportunities

- Table 6 — Examples of issues in relation to valuation and assessment of social impacts

- Table 7 — Examples of issues in relation to desired outcomes and implementation strategies and programmes/actions

- Table 8 — Sample of International Standards available for social factors

It also has a section 6.4 on Social KPIs.

Clause 7 covers governance considerations and contains the following tables:

- Table 9 — Examples of actions based on governance aspects

- Table 10 — Sample ESG questions for a constructive challenge structure

- Table 11 — Stages of ESG maturity and cultural attitudes

- Table 12 — Sample of ISO and IEC documents available for governance factors

Clause 7.4 addresses Governance KPIs.

Clause 8 on compliance and conformity of ESG factors contains table 13 — Parties carrying out conformity assessment activities.

Clause 9 contains guiding principles for reporting on ESG issues plus a useful table 14 on ISO and IEC documents available for reporting.

Clause 10 on Continual Improvement contains table 15 — ESG processes through a continual improvement lens.

There is also an annex A on assurance and conformity assessment and a very useful and comprehensive bibliography.

IWA 48 provides a high-level framework and set of principles on how to implement and embed environmental, social and governance (ESG) within the culture of an organisation to support management of ESG performance, measurement and reporting, thereby facilitating consistency, comparability and reliability of ESG reporting and practices universally.

Source: IWA 48:2024 – Environment, social and governance principles.