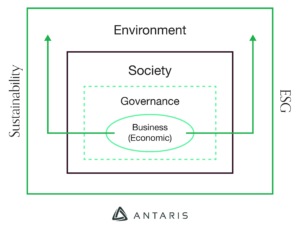

The terms ESG and Sustainability are often used interchangeably, but there are key differences. Check out our diagram below to understand some of the core differences and to make sure you are using the terms correct in your sustainability communications.

With an increase in awareness about business impacts on society and the environment, as well as new regulations coming into effect, such as the Corporate Sustainability Reporting Directive (CSRD), concepts like ESG and sustainability seem to be at the forefront of every conversation, so it’s more relevant than ever to understand what they refer to and how to apply them to your company. But where do ESG and sustainability meet? Where do they differ?

ESG relates to a company’s Environmental, Social and Governance aspects, setting a framework for stakeholders to understand an organisation beyond its financial aspects, being of particular relevance for investment purposes. Environmental considers the organisation’s environmental impacts, such as GHG emissions, resource use, energy efficiency, and waste management. Social refers to the company’s relationship to its stakeholders, including factors like human rights, diversity and inclusion, labour practices, and supply chain management. Governance relates to the way a company is managed, including its internal structure, controls and procedures, and the fulfilment of shareholder expectations, among others.

On the other hand, sustainability refers to the capacity to endure and it’s most commonly defined in the context of the Brundtland report1 where the concept for sustainable development was first introduced, which defines sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.” In a business context, this means carrying out the organisation’s activities whilst balancing its economic, environmental and socials factors, something known as triple bottom line. This framework is also referred to as “Profit, people, and planet”.

Report of the World Commission on Environment and Development: Our Common Future, 1987.

For the economic aspect, or profit, the focus is on maximising the organisation’s profitability while minimising costs and risk. The social side, or people, refers to the business’ impact on society. This includes both the internal and external stakeholders, as well as the wellbeing of the surrounding community. The environmental aspect, or planet, refers to the organisation’s environmental impact, reducing pollution, energy consumption or resource use, as well as aiding in ethical practices and the development of new technologies, for example.

As you can see, both concepts seem quite similar, they both state a business has to be profitable, socially responsible and avoid harming the environment, while creating value for stakeholders, but they have a different scope.

Whereas sustainability is a broader, holistic approach, ESG sets a specific set of criteria to evaluate an organisation’s performance. ESG metrics are considered by investors along traditional metrics while allowing for standardised reporting that lets companies obtain certifications or achieve internationally recognised standards. With metrics based on precise parameters, disclosures and guidelines can be developed and compared both within the company and against others in the industry.

In summary, whilst ESG measures the impact the world has on a company, sustainability focuses on how the company impacts the world.

Sources: